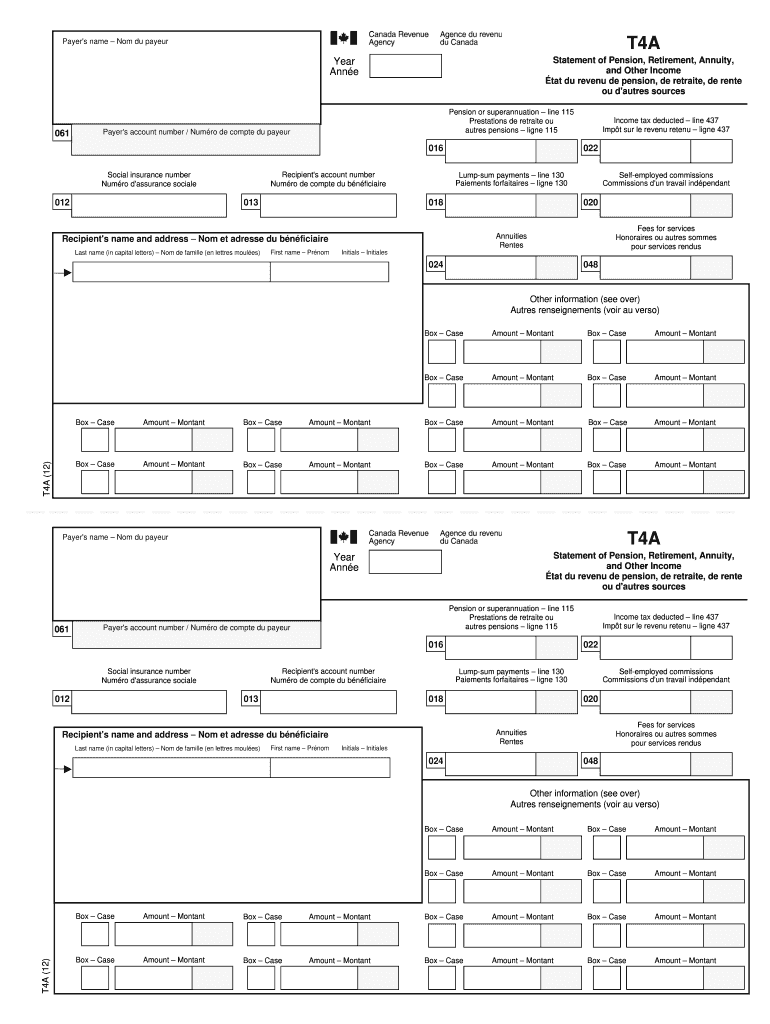

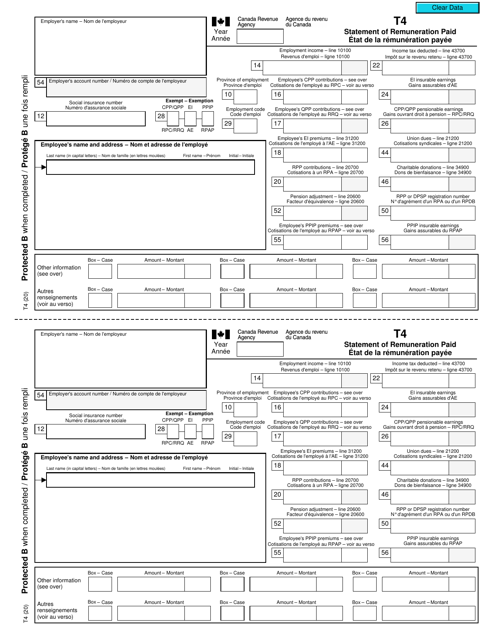

Yes, it isn't the same as filling in an actual T4 slip, but neither is the professional grade software You would have to double click on line 101 in the T1 general form to bring up an entry screen if working from the formPension income (including OAS/CPP or RCA) ☐ ☐ T4A, T4A(RCA), T4A(P), T4A(OAS) slips RRSP and RRIF income ☐ ☐ T4 RSP, T4RIF slips Employment Insurance (EI) benefits and repayments ☐ ☐ T4E slips Social assistance ☐ ☐ T5007 Investment income ☐ ☐ T3, T5, T600 slips Individual Income Tax Return Information Sheet Taxation Year 19Jun 21, · It is a tax slip that will be provided to an employee by an employer ComVida Corporation Filing T4 and T4A slips for 17 December 17 Page 11 Formally a T4 is a Statement of Remuneration paid Click T4 slip (employee) to prepare T4 slips to give to your employees How to Submit Your T4 Summary 1 3

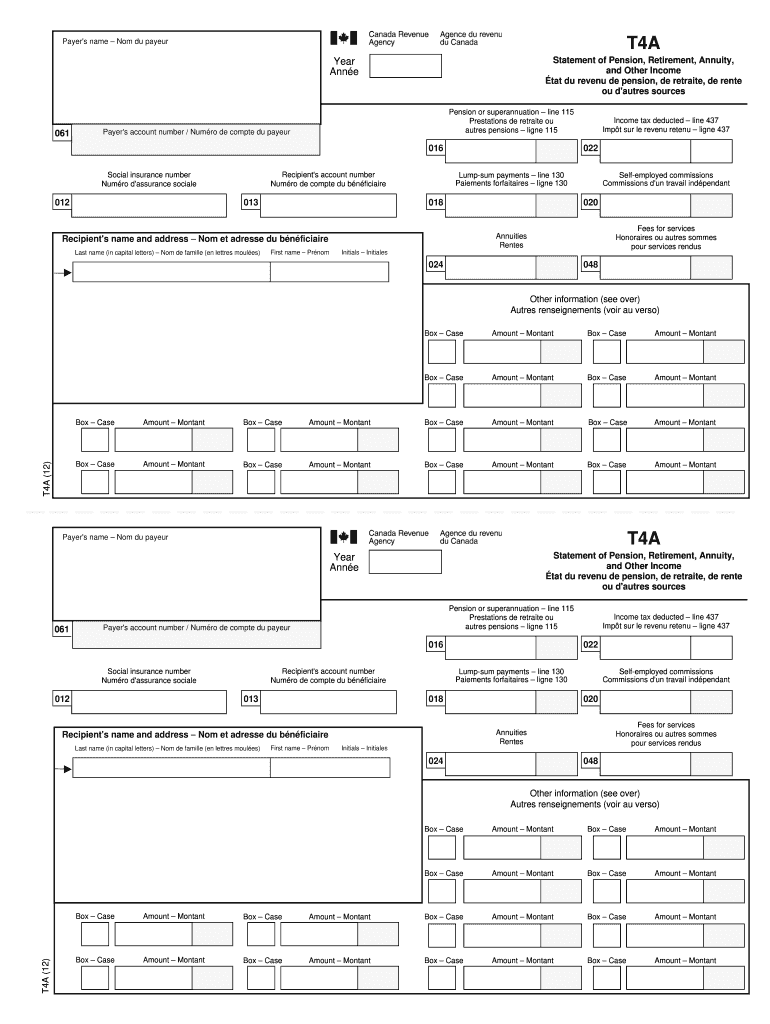

T4a Fillable Fill Online Printable Fillable Blank Pdffiller

2019 t4 slip fillable

2019 t4 slip fillable-This is the season for Tax filing and in this video I'm giving my 2 cents on what a T4 slip is and what all the numbers meanThere is no need to be scared ofWhat Is T4 Summary Fillable If you are an employer, you have to prepare a number of documents to report the financial information The T4 summary is a document that should be prepared by the employers, whether they are residents or nonresidents of the US, in case they pay certain types of income to their employees

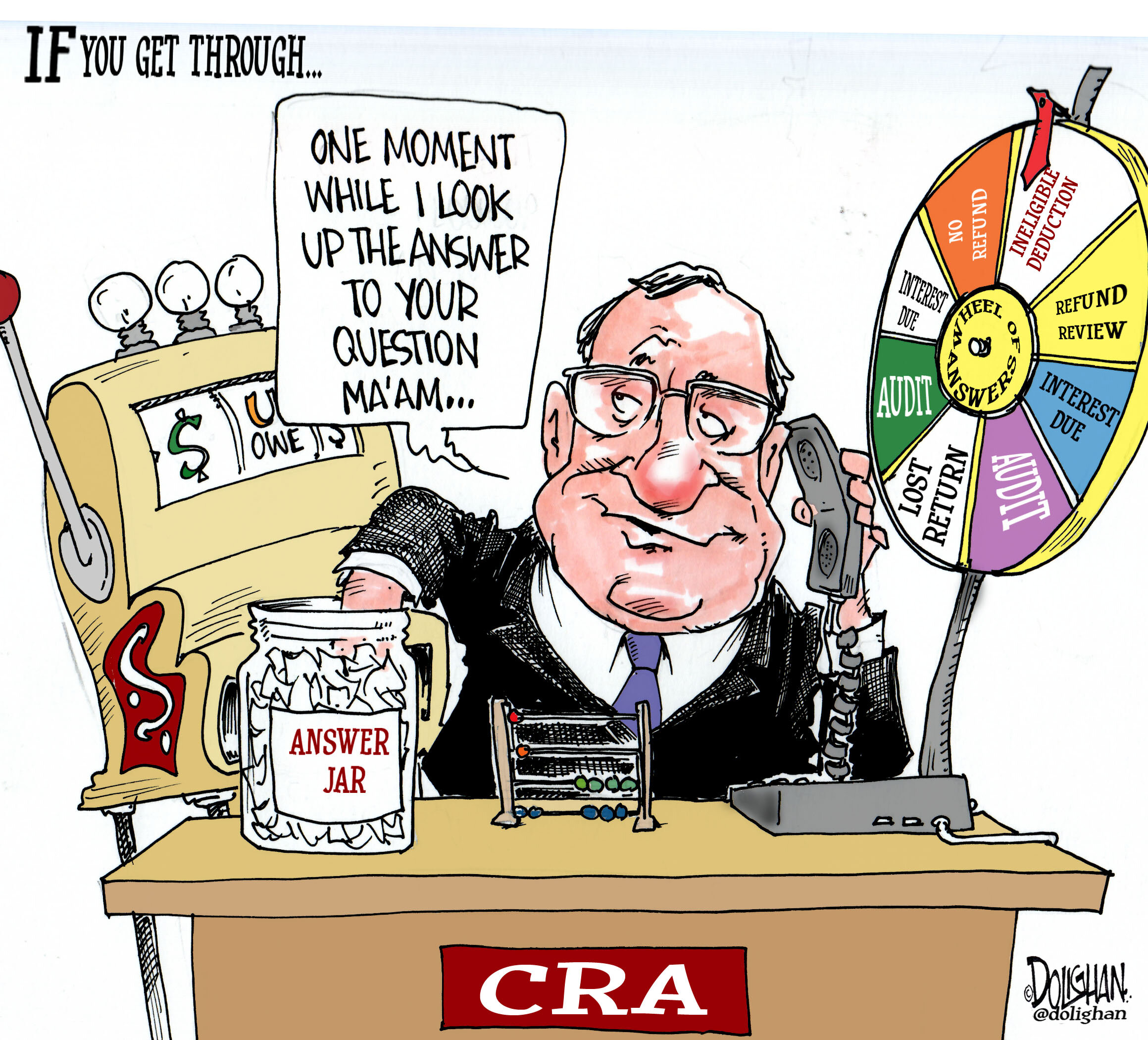

Income Tax Season What S Different About This Year S T1 Personal Income Tax Return Form Ctv News

Allows 3 periods to handle increased salaries;In the Select Year section, select the year you want printed Select an employee or employees from the list, or choose Select All to include all employees If you need to print T4 slips for inactive employees, select the Include Inactive Employees check box, and then select the inactiveOct 04, 12 · T4 Statement of Remuneration Paid (slip) Notice to the reader If you used our fillable or blank slips last year, save time and effort by using the Web Forms application to file up to 50 original, additional, amended or cancelled slips directly from the CRA Web site For more information, see Web Forms Please note that we have made changes to Box 87 on the back of the T4 slip

Fillable T4 Fill out, securely sign, print or email your t4a form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!This video will explain stepbystep how to prepare a T4 slip031 – What isLast update 1021 Related documents Using PDF forms

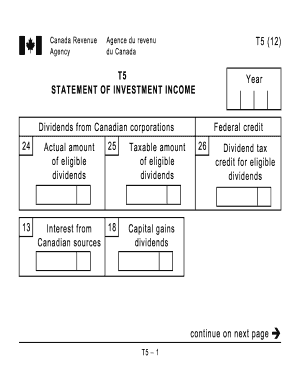

Fillable T5 Fill out, securely sign, print or email your t5 fillable 12 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aIf you have more than one employer account, you must file RL1 slips for each account, under the name and identification number shown on the Remittance of Source Deductions and Employer Contributions (form TPZ1015R141V, TPZ‑1015R142V, TPZ1015R143V or TPZ1015R144V, according to your remittance frequency) for each oneOct 14, 12 · T4 Statement of Remuneration Paid (slip) T4A Statement of Pension, Retirement, Annuity, and Other Income;

Everything You Need To Know To Understand Your T4 Slip Watch News Videos Online

Pa Schedule Ue 21 Fill Out Tax Template Online Us Legal Forms

RL slips and summaries must be filed in French To file an RL slip or summary using a fillable PDF, click Formulaires et publications, select a slip or summary and click Document PDF remplissable à l'écran (fillable PDF document) at the bottom of the access page After completing the slip or summary, you must print it and mail it to us We also recommend that you save a copy of the PDFJun 03, · You can view this form in PDF fillable/saveable t4sumfill19epdf Run a test T4/RL1 slip and summary report Filing t4 and t4a slips for 17 142 t4 web forms the t4 summary report will be displayed, which you can print for t4 fillable form employers' guide filing the t4 slip and summary l / rc41 (e) rev• payments from a wage loss replacement plan either paid directly by you or paid by a third party on your behalf (see "Box 14 – Employment income," on page 40 9, for more information);

T4 Fillable Fill Online Printable Fillable Blank Pdffiller

Chapter Review Problem 19 1 Assignment 2 Funda Chegg Com

In the Home window, on the Reports menu, choose Payroll, and then Print T4 Slips and Summary;Find and fill out the correct t4 summary fillable 19 signNow helps you fill in and sign documents in minutes, errorfree Choose the correct version of the editable PDF form from the list and get started filling it outMar 10, 12 · T4 slip You can get a PDF or PDF fillable T4 slip, Statement of Remuneration Paid You can make photocopies of completed slips to distribute to your employees

Fill Free Fillable T1 Adjustment Request Government Of Canada Pdf Form

Belgium Visit Visa Information Travel Visa Identity Document

Oct 21, · For best results, download and open this form in Adobe ReaderSee General information for details You can view this form in PDF t4sumepdf;Jun 19, · Finish tax return in minutes on laptop, tablet or smart phone T4 slip You can get a PDF or PDF fillable T4 slip, Statement of Remuneration PaidYou can make photocopies of completed slips to distribute to your employees When you work for an employer, you receive a T4 slip at tax time If you file on paper, alsoDownload Fillable Form 5005s10 Schedule 10 In Pdf The Latest Version Applicable For 21 Fill Out The Employment Insurance (ei) And Provincial Parental Insurance Plan (ppip) Premiums (for Qc And Nonresidents Only) Canada Online And Print It Out For Free Form 5005s10 Schedule 10 Is Often Used In Canadian Revenue Agency, Canadian Federal Legal Forms And Canada Legal Forms

T4a Fillable Fill Out And Sign Printable Pdf Template Signnow

Creating T4 T4a T5 Tax Slips For Printing And Electronic Filing Youtube

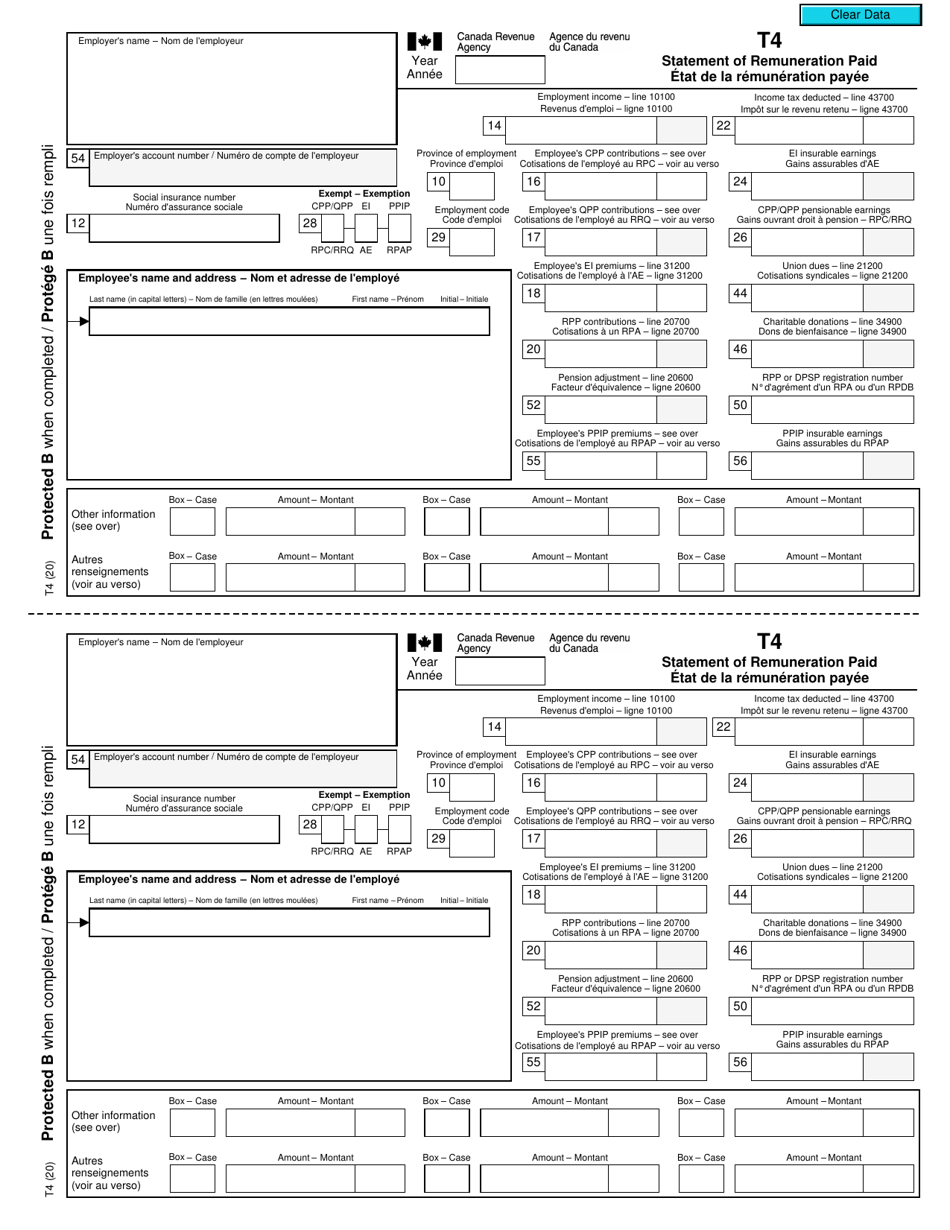

The T4 (Statement of Remuneration Paid) slips and Relevé1 (RL1) slips are used to report all income you paid to your employees over the previous calendar year to the Canada Revenue Agency (CRA) and Revenu Québec, respectively, including salaries, wages, taxable benefits (company contributions), commissions, and any other remuneration you give to your employees (such asDec 21, 17 · Forms and publications Form T4ANR, Statement of Fees, Commissions, or Other Amounts Paid to NonResidents for Services Rendered in Canada Form T4ANRSUM, Fees, Commissions, or Other Amounts Paid to NonResidents for Services Rendered in CanadaT4 Slip Fillable is not the form you're looking for?

Form T4 Download Fillable Pdf Or Fill Online Statement Of Remuneration Paid Canada English French Templateroller

T4a Summary Form 19 Get The Free T4 Summary Fillable Form

Form T4 Download Printable Pdf Or Fill Online Statement Of Profile 19 chapter 4 final what s the difference between an noa t4 and t1 general?T4 Summary Summary of Remuneration Paid General The T4 information return includes the T4 Summary and copy 1 of the T4 slips It must be filed no later than the last day of February following the calendar year to which the information return applies, usingJun 12, 18 · Click File electronically now to open the Export T4s (Internet File Transfer) window and begin filing the T4 slips electronically Printing T4 slips and summary You can use Sage 50 Accounting to print T4 slips and its associated T4 summary on preprinted forms or on plain paper If you are using preprinted forms, we recommend you do a test

Form T4 Download Fillable Pdf Or Fill Online Statement Of Remuneration Paid Canada English French Templateroller

How To Prepare A T4 Slip In 12 Easy Steps Madan Ca

If you need to include more payments from other forms of income, you can use another slip Difference between T4, T4A and T4A(P) forms A T4 is a statement of remuneration paid You were receive this form if you were employed during the year A T4A is a statement of pension, retirement, annuity, and other incomeFiles your T4 information return with the CRA electronically via the Internet or on paper Prints your T4 slips and summaries on plain paper or CRAsupplied forms Generates individual slip PDFs for electronic distribution to recipients Distributes your slips to recipients via email or your intranet or employee portal• income for special situations such as barbers and hairdressers, taxi drivers and drivers of other passengercarrying vehicles, fishing income, Indians, placement

T4 Fillable T4 Statement Of Remuneration Paid

Caldwell Scaricare Libro Digitale 1 37 Pagine Pubhtml5

The tax calculator is integrated with T4 slip and displays the calculated data in the corresponding boxes after the annual salary is entered Some features are listed below Prorates the gross income based on the working days if the employment starts/ends in the middle of the year;Canada T 1921 T Form Choose online fillable blanks in PDF and add your signature electronically Manage templates from your PC, mobile and tablet Reliable service without installation Try now?Jul 03, 19 · Sample T4A(OAS) Tax Slip This sample T4A(OAS) tax slip from the CRA site shows what a T4A(OAS) tax slip looks like For more information on what is included in each box on the T4A(OAS) tax slip and how to deal with it when filing your income tax return, click on the box number in the pulldown menu above the sample T4A(OAS) tax slip

Download T4 From Cra Format Online

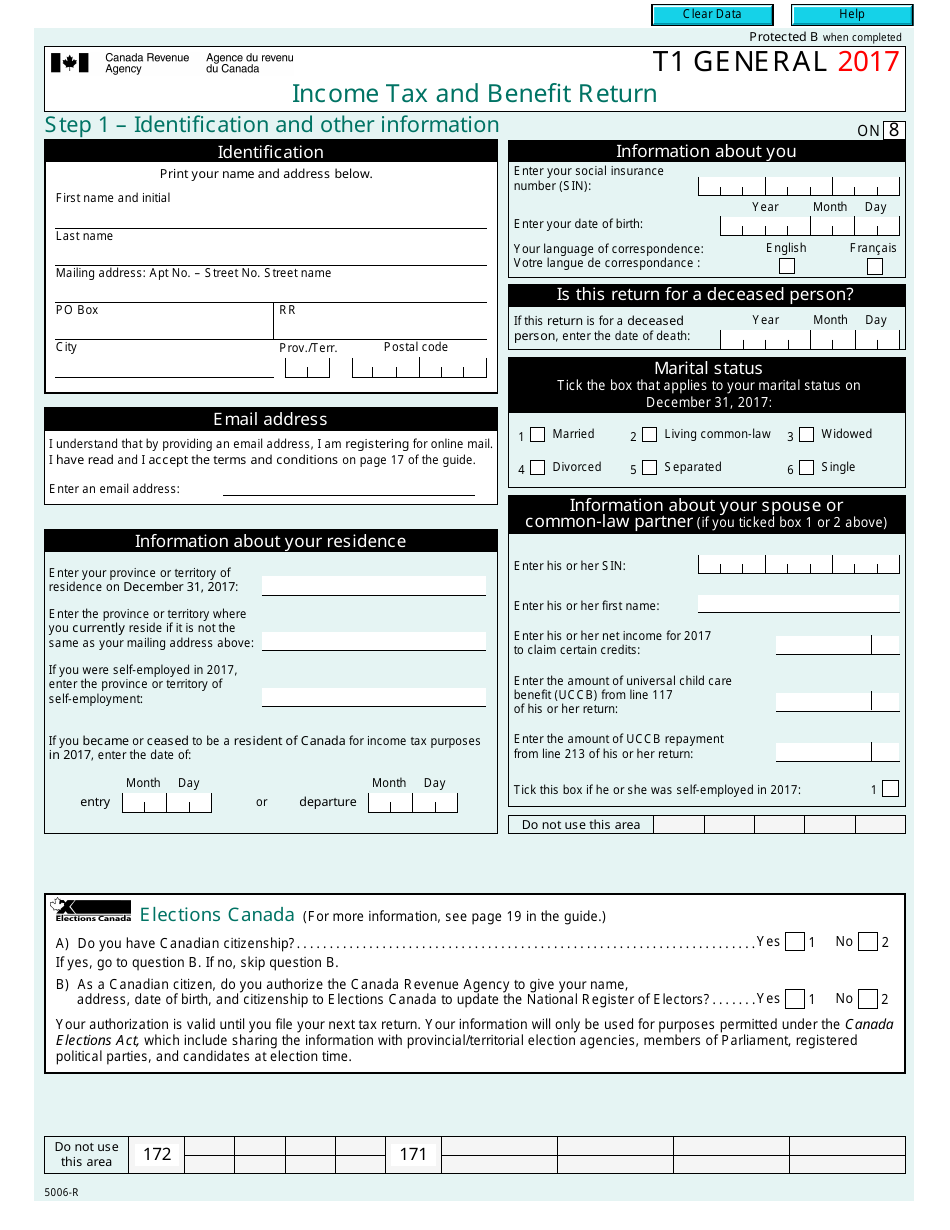

Fill Free Fillable Form 8 T1 General 16 Income Tax And Government Of Canada Pdf Form

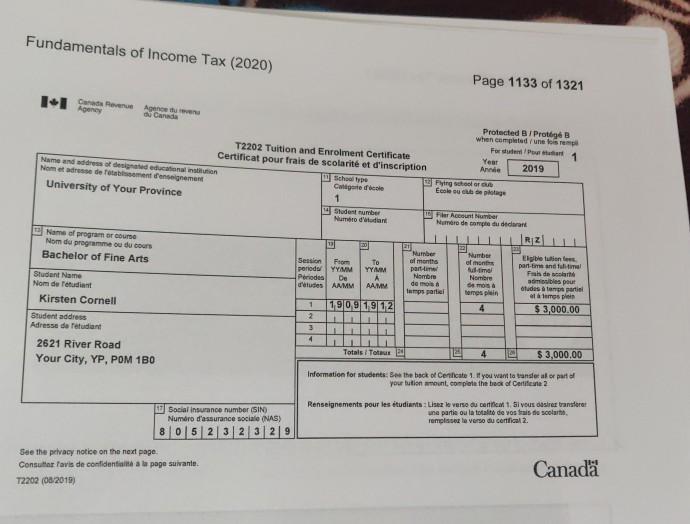

Are you an employer who wants to report salary and wages paid to your employees?Jan 19, · A Canadian T4A(P) tax slip, or Statement of Canada Pension Plan Benefits, is issued by Service Canada to tell you and the Canada Revenue Agency how much you received in Canada Pension Plan benefits during a tax year and the amount of income tax that was deducted Canada Pension Plan benefits include retirement, survivor, child, and death benefitsCanadian Forces personnel and police deduction (box 43 of all T4 slips) 52 Security options deductions (boxes 39 and 41 of T4 slips or see Form T1212) 53 Other payments deduction (claim the amount from line 27, unless it includes an amount at line 26 If so, see line in the guide) 54

T4 Fillable T4 Deadline 19

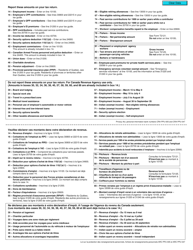

Chapter Review Problem 19 1 Assignment 2 Funda Chegg Com

RL1 Slip Employment and Other Income (courtesy translation) RL1T The RL1 slip must be filed by any employer or payer that paid amounts such as salaries, wages, gratuities, tips, fees, scholarships or commissions The information on the RL1 slip is used by individuals to complete the personal income tax return (TP1V)Your 19 Tax Checklist Get ready for tax season with our 19 Tax Checklist Use this fillable PDF Tuition slips (T22A) for yourself or from a child * (T4) and employee profit sharing E (T4PS) slips * Employment Insurance slip (T4E) *T4 slip fillable 19 t4a summary fillable 19 t4 summary sample t4 summary guide t4a fillable adp t4 summary t4 forms tax summary form How to create an eSignature for the t4 form Speed up your business's document workflow by creating the professional online forms and legallybinding electronic signatures

Form T4 Download Fillable Pdf Or Fill Online Statement Of Remuneration Paid Canada English French Templateroller

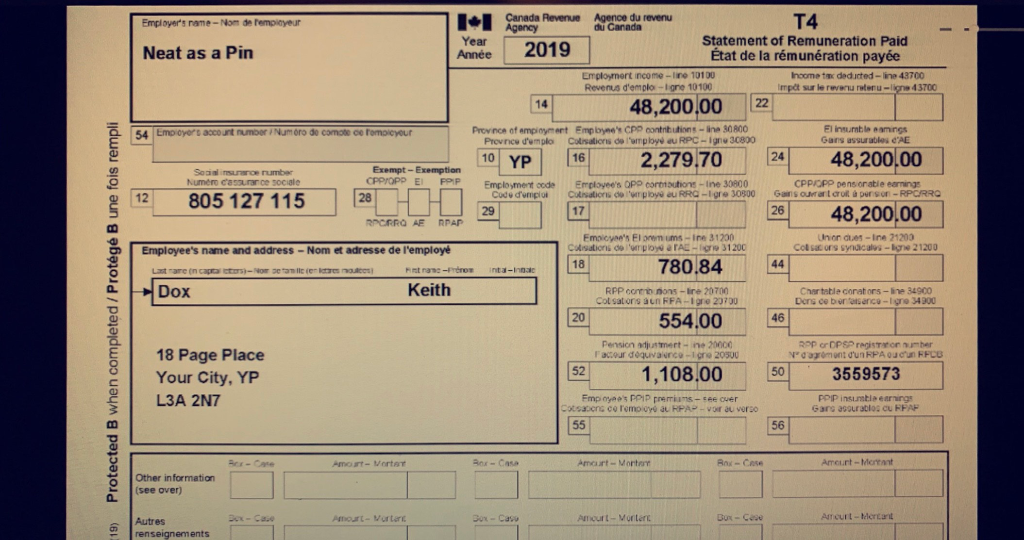

Employer S Name Nom De L Employeu Canada Revenue Agonce Ou Revenu T4 Neat As A Pin Year 19 Statement Of Remuneration Paid Etat De La Remuneration Course Hero

RATION PAY E Employment income line 101 Revenus d'emploi ligne 101 Income tax deducted line 437 Imp t4 slip fillable T4 Wikipedia, the free encyclopedia Email Signature Restaurant Customer Satisfaction Survey Template Every customer for your business needs a receipt for their records You need a receipt to track your sales and products soldMarch 2, In Canada, every employer is required by law to complete T4 statement of remuneration paid slips and summaries for the prior year by the last day of February, or, if the last day of February falls on a weekend, the first business day following thatDec 19, 19 · There are several ways to fill out your T4 forms If preparing one or two slips, you can use the fillable forms provided by the CRA Information that you need to prepare the T4 slip Keep in mind that when the forms are submitted manually, a summary will also have to be prepared No summary is required when slips are filed electronically

Form T1 General Download Fillable Pdf Or Fill Online Income Tax And Benefit Return 17 Canada Templateroller

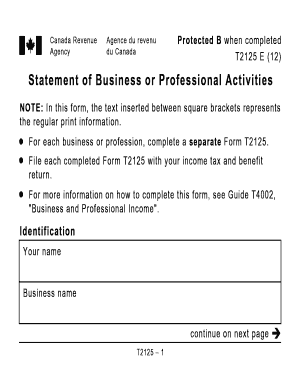

T2125 Fill Out And Sign Printable Pdf Template Signnow

T4 Statement of Remuneration Paid Employers must complete T4 Slips for all employees who received salary, wages , tips or gratuities, An alternative option to ordering slips and summaries is to use the CRA's Web Forms application PDF fillable/saveable t4fillepdfCreate a T4 form in minutes using a fillable PDF editor A T4 form, known as a Statement of Remuneration Paid, is a tax slip that will be provided to an employee by an employerSlips and COVID19 CEWS, TWS, PD27, TS and T4 Slips (Revised) The measures introduced by the federal government to support employers during the COVID19 pandemic require employers to complete new forms and report additional information when filing T4 slips Here are answers to common questions we've received from TaxCycle preparers

T4a Summary Fillable

What Is A T4 Slip Canada Ca

Refund slip form (page 1) line 17qq com atf 4473 (omb no 1140 00) comments responses april 16 date of submission name respondent contact information commenMar 02, · When is the T4 19 deadline?Get And Sign T4 Slip Form Allowances;

How To Create And Submit T4 Slips Canadian Payroll

T4a Fillable Fill Online Printable Fillable Blank Pdffiller

T4ANR Statement of Fees, Commissions, or Other Amounts Paid to NonResidents for Services Rendered in Canada;Click Next to approve the supplier's T5018 slip Repeat Step 4 to review the T5018 slips for the other suppliers you marked On the last T5018 slip, click OK QuickBooks Desktop returns to the Process End of Year Forms window and confirms that you verified all supplier T5018s by placing a checkmark in the Reviewed columnT4ANRSUM Summary of Fees, Commissions, or Other Amounts Paid to NonResidents for Services Rendered in Canada

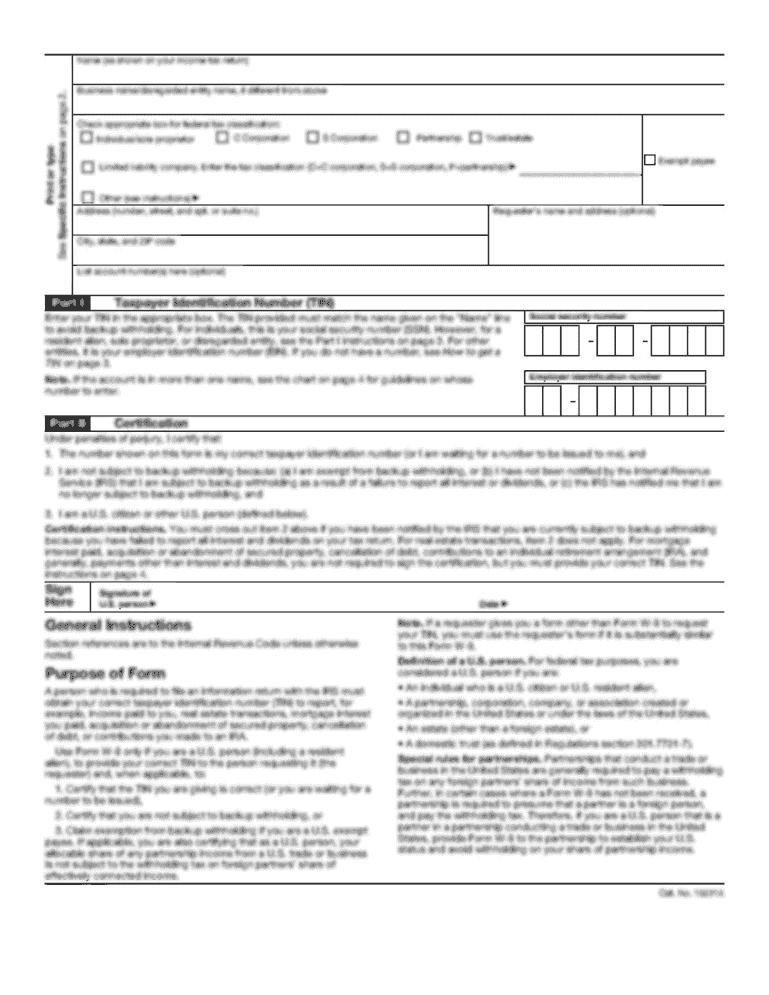

Form W 9 Wikipedia

Information On Filing T4s Rl 1s And T4as For Small Business Owners

Search for another form here Search Comments and Help with t4 pdf fillable Video instructions and help with filling out and completing t4 fillable Instructions and Help about t4 fillable form hi there my name is Michael and in this video I'm going to show you how to create some tea forFeb 09, 21 · how to access the T5 slip The first step is to obtain the T5 slip Download a PDF at CRA's website at the PDF linkNote that there is a fillable version which means the slip can be directly edited from your computer rather than having to write in the amounts by hand

How To Prepare A T4 Slip In 12 Easy Steps Madan Ca

T4 Fillable Revenue Canada T4 Fillable Forms

Download T1 General Cra Network Number 1

Taxpayersinformation Taxpayer 1 Name Keith Doxsin 805 127 115 Dob August 13 1985 Marital Status Marriedaddress Place Your City Yp L3a 2n7 Course Hero

Form T4 Download Fillable Pdf Or Fill Online Statement Of Remuneration Paid Canada English French Templateroller

How To Prepare A T4 Slip In 12 Easy Steps Madan Ca

Using Pdf Forms Canada Ca

Canada T1213 Oas E 21 Fill And Sign Printable Template Online Us Legal Forms

Form T1 General Download Fillable Pdf Or Fill Online Income Tax And Benefit Return 17 Canada Templateroller

Creating T4 T4a T5 Tax Slips For Printing And Electronic Filing Youtube

Td4 Forms 18 Trinidad Fill And Sign Printable Template Online Us Legal Forms

Employer S Name Nom De L Employeur Canada Revenue Agency Agence Du Revenu Du Canada T4 Neat As A Pin Year Statement Of Remuneration Paid Annee 19 Course Hero

Profile T2125 Forms Cute766

T5 Recipient Type Fill Out And Sign Printable Pdf Template Signnow

Fillable T4 Slip Canadian Statement Of Remuneration Paid Pdf Formswift

Fill Free Fillable Forms Brescia University College

Taxpayersinformation Taxpayer 1 Name Keith Doxsin 805 127 115 Dob August 13 1985 Marital Status Marriedaddress Place Your City Yp L3a 2n7 Course Hero

Tax Info Checklist Booth Partners

What Is Line 101 Tax Return Canada

Cpp Death Benefit And Survivor Payment Kwb Chartered Professional Accountants Edmonton

Starting A New Job In Canada

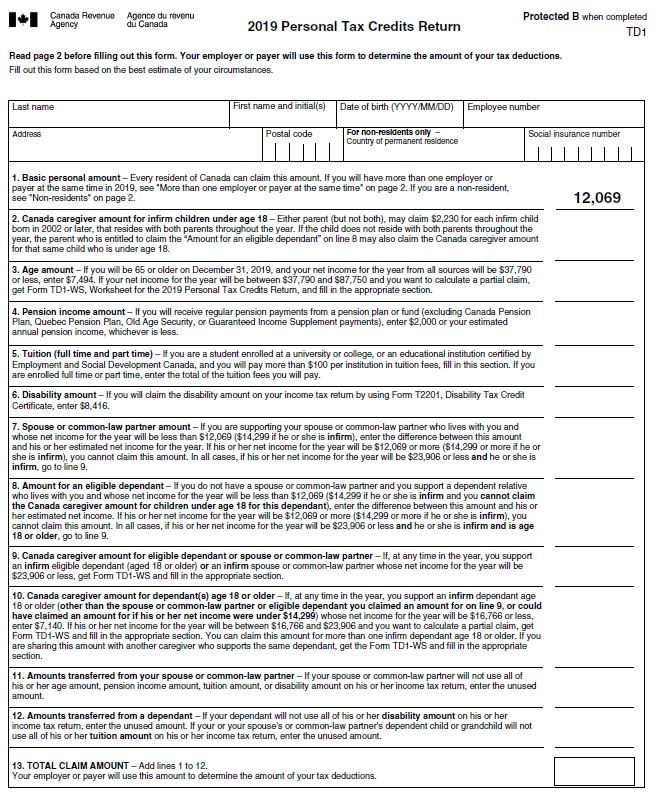

Td1 Ontario Federal

T4 Fillable Fill Online Printable Fillable Blank Pdffiller

Canada Revenue Agence Du Revenu Protected B Protege B Agency Du Canada When Completed Une Fois Rempli For Student Pour Etudiant 1 T22 Tuition Course Hero

How To Prepare A T4 Slip Youtube

How To Prepare A T5 Slip Madan Ca

How To Prepare A T4 Slip In 12 Easy Steps Madan Ca

Taxpayers Information Taxpayer 1 Name Keith Dox Chegg Com

Taxpayersinformation Taxpayer 1 Name Keith Doxsin 805 127 115 Dob August 13 1985 Marital Status Marriedaddress Place Your City Yp L3a 2n7 Course Hero

T4 Summary Fillable Fill Out And Sign Printable Pdf Template Signnow

T4 Slip Lost Here S How To Access Lost Or Old T4 Slips

T4 Fillable Fill Out And Sign Printable Pdf Template Signnow

Year End Central

Fill Free Fillable Form 8 T1 General 16 Income Tax And Government Of Canada Pdf Form

Income Tax Season What S Different About This Year S T1 Personal Income Tax Return Form Ctv News

T4a Summary Fillable Hm Are You A Human

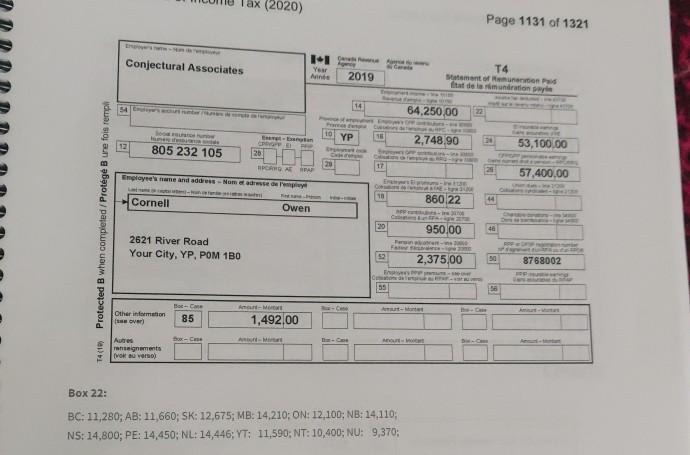

Chapter Review Problem 19 1 Assignment 2 Funda Chegg Com

:max_bytes(150000):strip_icc()/CRAFormT2125-a3f2076202c546f1b72af673d094e89b.png)

Cra Form T2125 What Is It

Fill Free Fillable T1 Adjustment Request Government Of Canada Pdf Form

Fillable T4 Slip Canadian Statement Of Remuneration Paid Pdf Formswift

T4 Fillable Fill Online Printable Fillable Blank Pdffiller

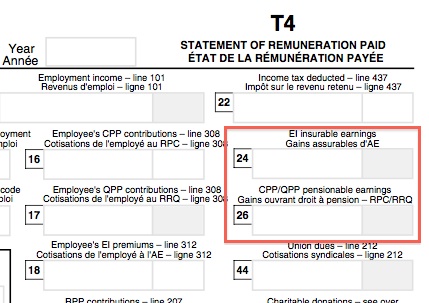

T4 With Box 24 And 26

T5 Fillable Fill Out And Sign Printable Pdf Template Signnow

T4 Summary Fillable Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Sun Life Account Number On T4a Form Fax Email Print Pdffiller

Cra Payroll Quickbooks Payrolls Cra Payroll Forms Payroll Online Cra Payroll Online Remittance

Td1 Ontario

0 件のコメント:

コメントを投稿